The AdFi Manifesto

The AdFi Manifesto

Alkimi on Sui

TL:DR

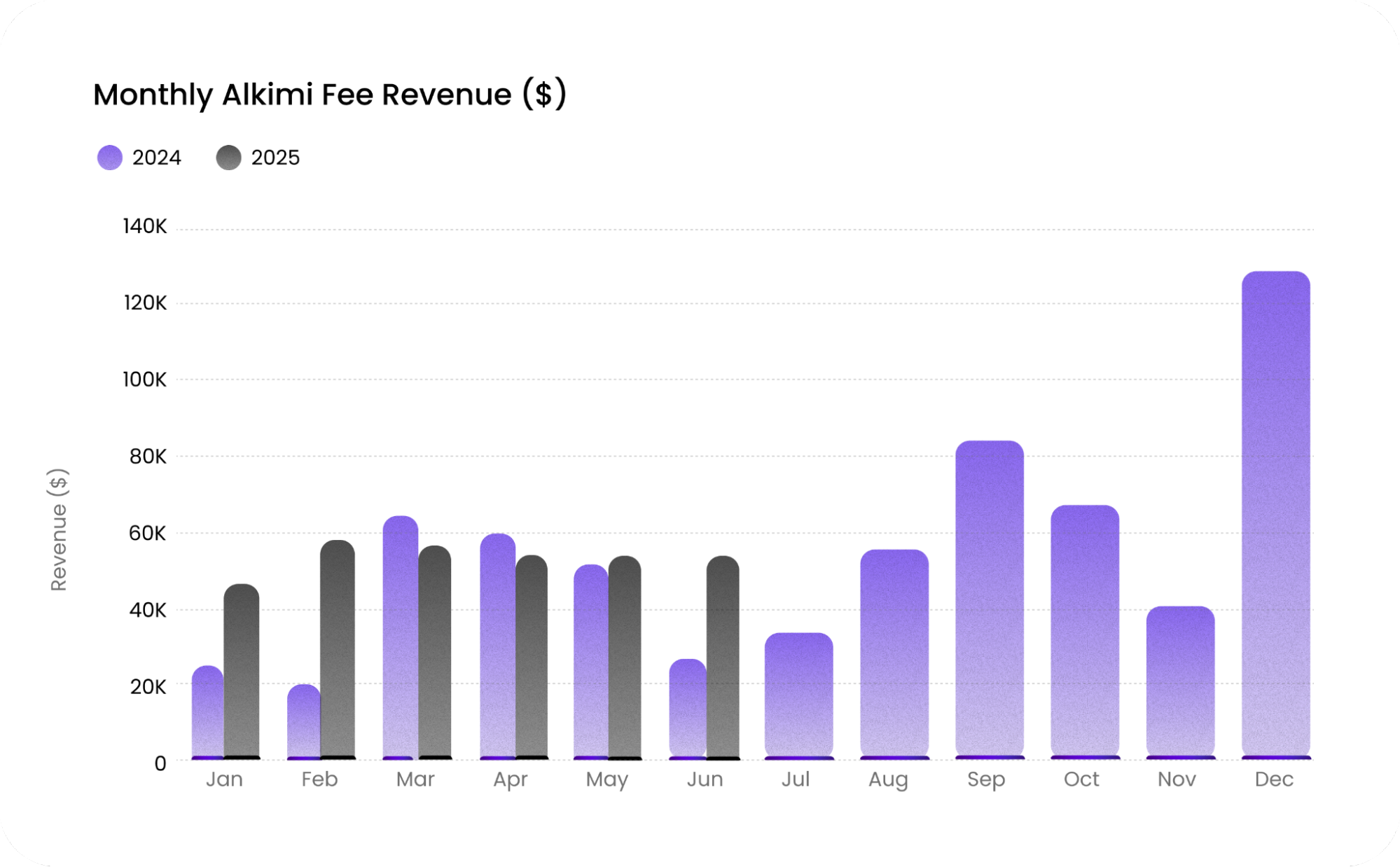

Alkimi has built the first on-chain advertising exchange that eliminates the inefficiencies plaguing the $750 billion digital advertising market. By leveraging blockchain technology and the Sui ecosystem, Alkimi creates a transparent marketplace where advertisers save up to 40% on fees whilst publishers receive instant payments through the revolutionary Advertising Finance (AdFi) protocol. Since Q4 2023, Alkimi has demonstrated exponential growth with protocol fees increasing from $46,000 to over $510,000 in 2025 representing a 1,100% increase in revenue, distributed directly to ALKIMI token holders. With partnerships including Coca-Cola, Publicis, Kraken, IPG, and Fox, Alkimi has proven its ability to bridge traditional advertising with decentralised finance.

The ALKIMI token captures value through AdFi benefiting from multiple revenue streams: protocol fees (3-8% of all transactions), publisher financing fees (up to 15% APY for liquidity providers), and the resulting systematic buybacks. Token holders benefit from real yields generated by actual advertising transactions, not inflationary emissions.

Founded in 2021, Alkimi has built the first on-chain digital ad exchange that eliminates the opacity and excessive fees plaguing the $750 billion digital advertising market. Every transaction generates protocol fees that flow directly to ALKIMI token holders.

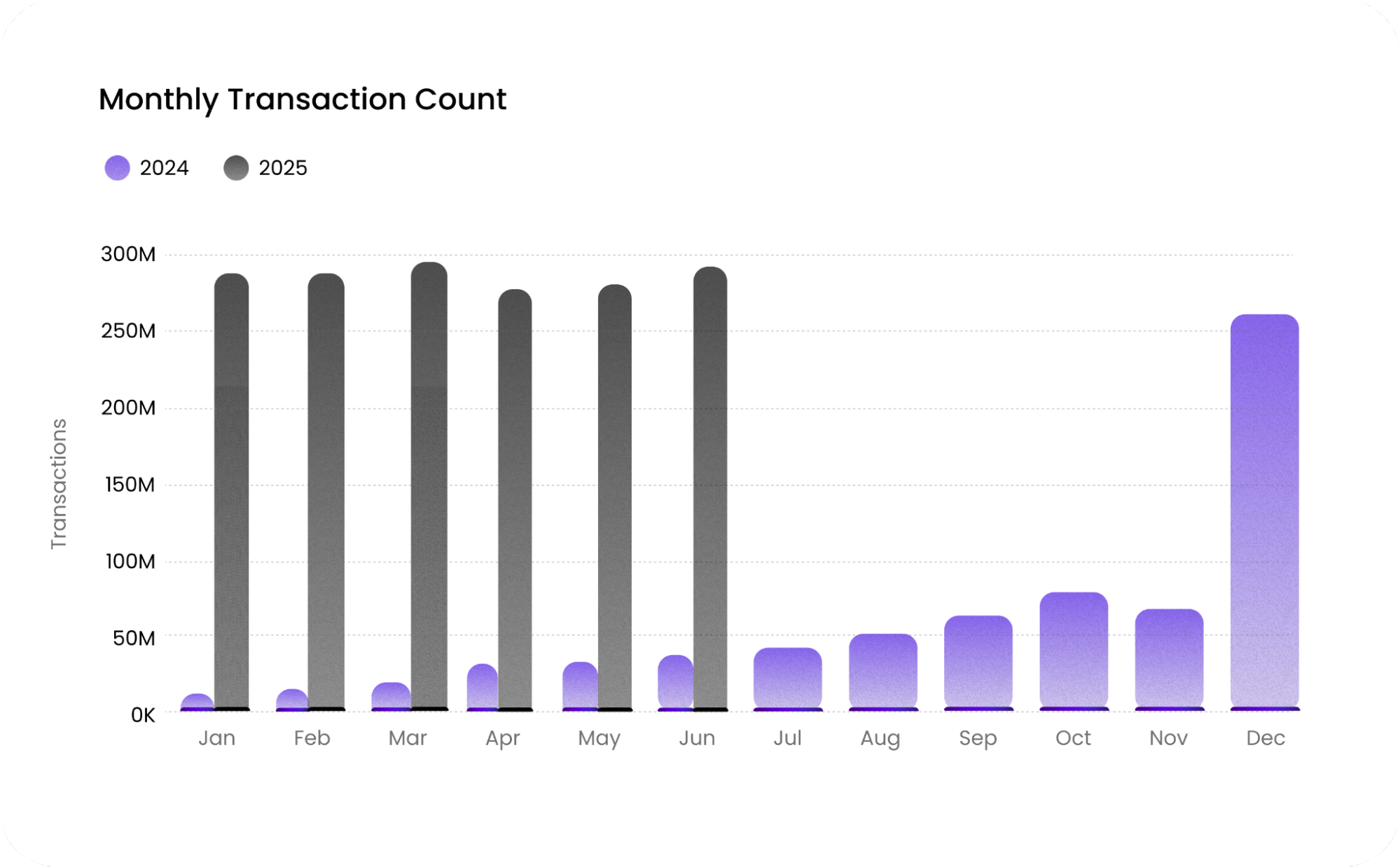

Starting from just over $46,000 in Q4 2023, Alkimi's quarterly protocol fees grew to $260,000 in Q4 2024 and have already exceeded $510,000 in 2025, representing over 1,100% growth in revenue that's distributed to stakers. With over 2.5 billion transactions processed and partnerships secured with global brands including Coca-Cola, Publicis, Kraken, IPG, and Fox, Alkimi has proven product-market fit whilst establishing a sustainable revenue model where each new brand partnership directly increases token holder rewards.

The strategic migration to Sui positions Alkimi to scale this revenue-generating engine, leveraging Sui's high-performance infrastructure to process millions of daily ad transactions at minimal cost, thereby maximising the protocol fees captured and distributed to ALKIMI holders whilst supporting the next phase of exponential growth in utility, efficiency, and long-term value creation across the ecosystem.

Figure 1: Monthly Alkimi Transaction Count

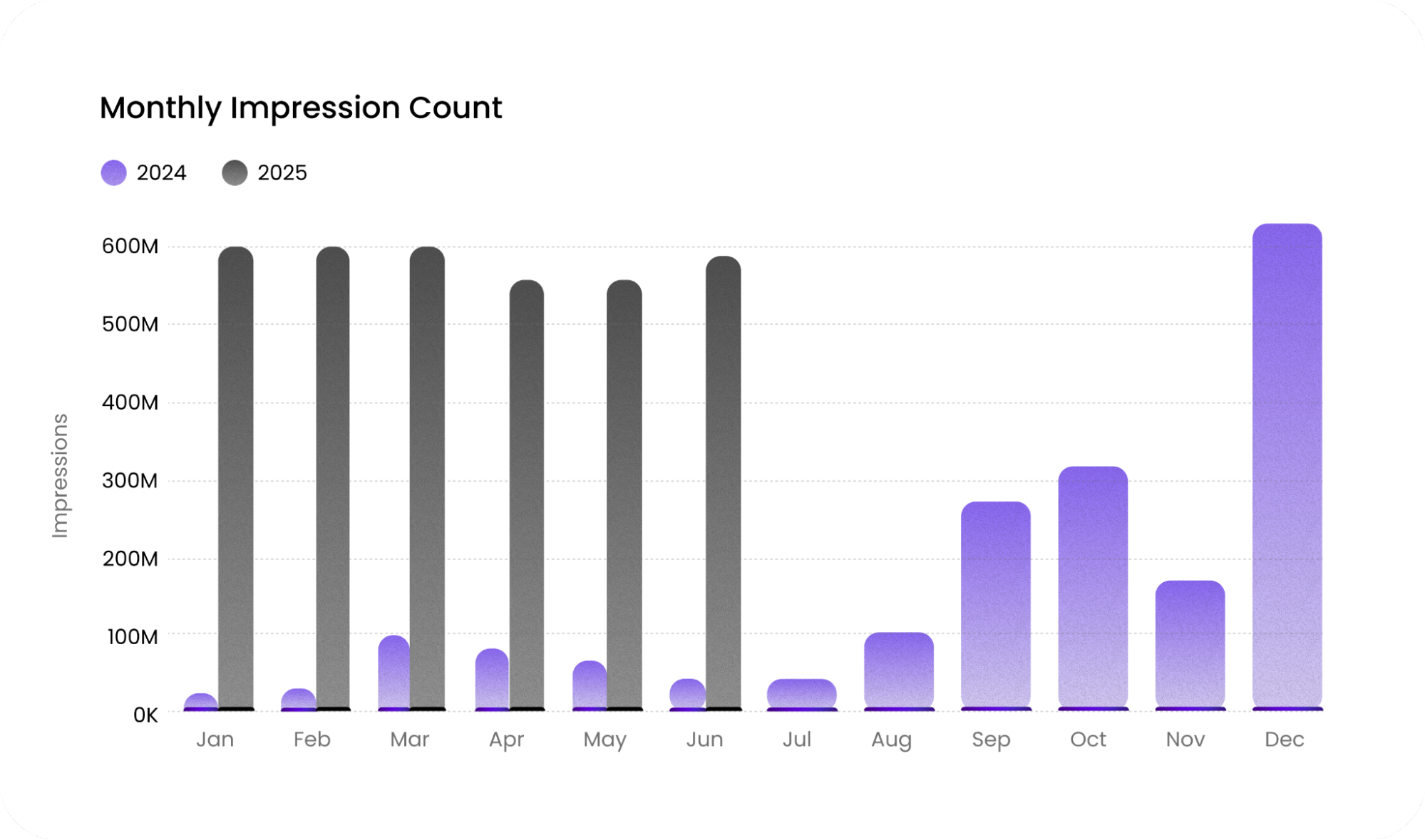

Figure 2: Monthly Alkimi Advertising Impression Count

Figure 3: Monthly Alkimi Advertising Protocol Fee Revenue

2. The $750 Billion Digital Advertising Revolution

The digital advertising ecosystem faces three critical challenges:

• Advertisers and Media Agencies lose up to 40% of media budgets paying excessive fees with zero transparency of where their ad spend actually goes.

• Publishers remain severely underpaid for ad inventory and forced to use expensive financing to cover 90-120 day payment gaps.

• DeFi Investors continue searching for sustainable yields from real-world business activity, not inflationary token emissions.

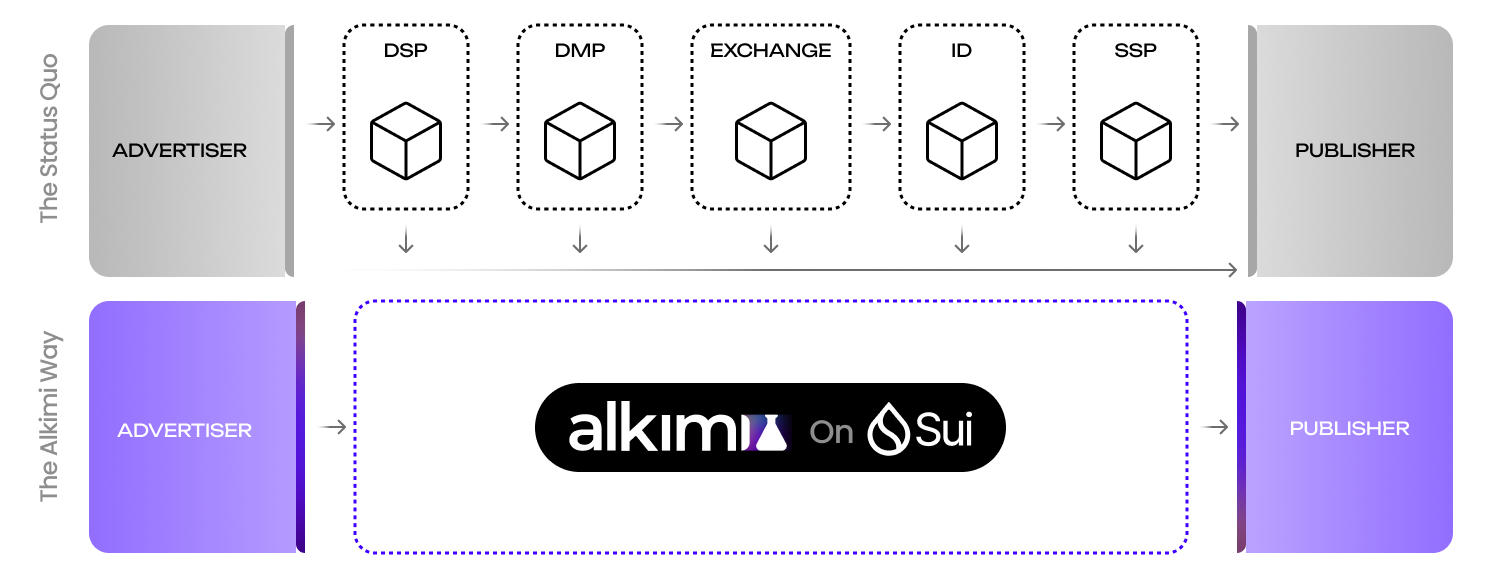

With up to 40% of advertising spend absorbed by intermediaries (represented by the multiple technology platforms, data providers, and service layers that sit between advertisers and publishers), both sides suffer from opaque fees, complex reconciliation processes, and payment delays, creating significant yield opportunities for ALKIMI token holders.

Figure 4: The current media advertising value chain Vs Alkimi’s

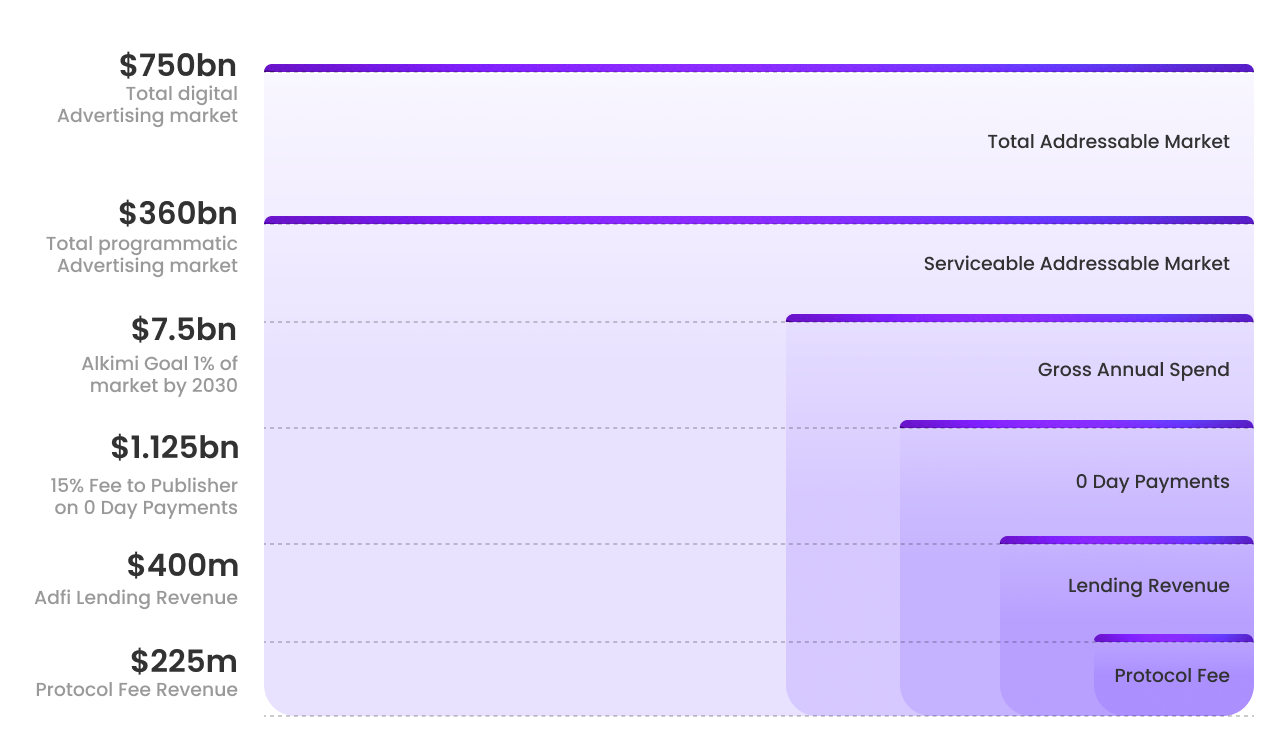

This opportunity represents a vast market where blockchain infrastructure eliminates inefficiencies whilst channeling captured value directly to token holders. With just 1% penetration, Alkimi would process $7.5 billion in ad spend annually. At a protocol fee of 3-8%, this translates to $225-600 million in annual revenue flowing directly to ALKIMI stakers, yields generated from real business activity, not unsustainable farming rewards.

This marks just the beginning of the opportunity.

3. The Market Opportunity

The convergence of DeFi and advertising presents an untapped opportunity worth hundreds of billions, with ALKIMI token holders at the forefront of capturing this value.

Figure 5: Alkimi’s target addressable market

By tokenising ad inventory into programmable money flows, Alkimi transforms a broken payment system into a yield-generating machine, and is already processing ~20 million ad impressions daily in 2025.

Leveraging Sui's complete technology stack, from sub-second finality to decentralised storage, Alkimi's Ad Exchange is uniquely positioned to capture value from both the advertising market and Sui's thriving ecosystem of 1 million active wallets and $2 billion in TVL.

Alkimi pioneers AdFi (Advertising Finance), (which will be covered in detail in section 4) which embodies the financialisation of advertising. With AdFi, Publishers can access instant liquidity by accepting a discount on their ad revenue earned through Alkimi's Exchange, revenue that's already higher than traditional platforms due to the significantly lower transaction fees. Fees collected are allocated towards ALKIMI token buybacks.

Through this mechanism, ALKIMI holders capture fees from both sides: 3-8% protocol fees from every transaction plus yields from liquidity provisioning. AdFi creates a powerful flywheel where more publishers drive more demand from advertisers, attracting more liquidity, improving rates, and accelerating adoption, with each rotation increasing value for token holders.

Both the advertising and DeFi markets have matured enough to support sophisticated financial products, yet remain fragmented enough for Alkimi to capture significant market share.

Three forces converge to create the perfect opportunity for AdFi; advertisers demanding transparency after decades of hidden fees, publishers desperate to boost revenue and escape crushing 90-day payment cycles, and DeFi users seeking sustainable yields backed by real business revenue.

4. Understanding AdFi: The Future of Advertising Finance

AdFi transforms the $360 billion cash flow problem in advertising into a yield-generating mechanism for ALKIMI token holders. Whilst publishers wait 90-120 days for payment, advertisers and media agencies retain capital, AdFi creates a decentralised lending market that captures value from this inefficiency.

The mechanism operates as follows:

Publishers gain instant liquidity against verified ad revenue earned from Alkimi's Ad Exchange.

ALKIMI and stablecoin holders provide the bridge liquidity.

Liquidity Providers earn yield from both protocol fees (3-8% of all transactions) and early payment fees (up to 15% fees per billing period from publishers).

4.1 How AdFi Works

For publishers, AdFi enables instant access to liquidity against verified ad revenue earned from selling ads via Alkimi's Ad Exchange. Smart contracts confirm delivery and payment obligations, offering early access to funds at competitive rates.

Advertisers benefit by maintaining traditional payment terms whilst utilising reduced reconciliation costs and increased transparency through on-chain payment systems.

ALKIMI and stablecoin holders provide liquidity into AdFi pools and earn genuine yields backed by completed advertising transactions.

4.2 Earning Yield with ALKIMI

AdFi creates multiple revenue streams that compound value for ALKIMI holders:

Protocol Fees (3-8%): 100% of all net protocol fees generated are distributed to ALKIMI stakers. • Display Advertising - 3%

• Video Advertising - 5% • Connected TV Advertising - 8%

This provides base yield from all platform activities.

Protocol Fee Structure:

Gross Ad Spend * Protocol Fee % = Gross Protocol Fee Gross Protocol Fee - (Sui Gas + Walrus Fee) = Net Protocol (NP) Fees

Illustrative,

$1.00 * 0.05 = $0.05 Gross Protocol Fees $0.05 - ($0.005 + $0.005) = $0.049 Net Proto col (NP) Fees

Early Payment Premium (0-15%): When publishers choose instant liquidity, they pay a fee up to 15% per billing period, depending on their preferred payment date.

Early Payment Fee Structure:

(N - ( T * D ))

*taken from the Net Ad Spend.

N (Publisher Access Fee at Day 0) - T (days after billing period) * D (Fee Reduction per day)

N = 15.00%, D = 0.25%,

Total Fee Structure (Protocol Fees + Early Payment Fee):

Example of $100 of Gross Ad Spend paid on Day 0;

Gross Ad Spend - Net Protocol Fee = Net Ad Spend - Publishers Access Fee = Publisher Revenue on Day 0

$100 - 5% - ($95 * (15% - (0 * .25%)) = $80.75

$100 - $80.75 = $19.25 Total Fee Revenue

Day 0: $100 - 5% - ($95 × (15% - (0 * 0.25%))) = $80.75

Day 1: $100 - 5% - ($95 × (15% - (1 * 0.25%))) = $80.99

Day 2: $100 - 5% - ($95 × (15% - (2 * 0.25%))) = $81.22

Day 3: $100 - 5% - ($95 × (15% - (3 * 0.25%))) = $81.46

Day 4: $100 - 5% - ($95 × (15% - (4 * 0.25%))) = $81.70

… 0.25% increments …

Day 57: $100 - 5% - ($95 × (15% - (57 * 0.25%))) = $94.29

Day 58: $100 - 5% - ($95 × (15% - (58 * 0.25%))) = $94.53

Day 59: $100 - 5% - ($95 × (15% - (59 * 0.25%))) = $94.76

Day 60: $100 - 5% - ($95 × (15% - (60 * 0.25%))) = $95.00

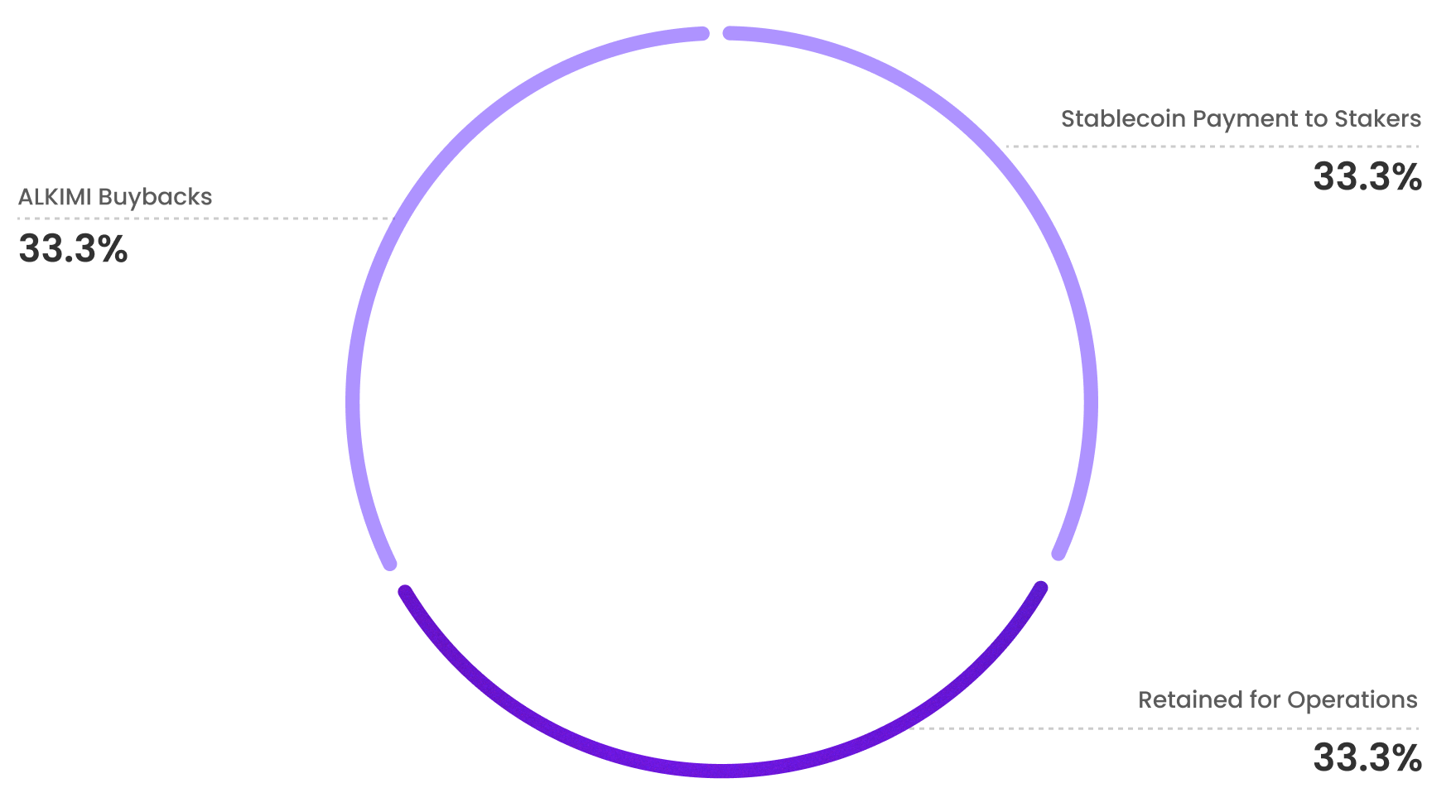

This fee is split three ways:

• 33.3% for systematic ALKIMI buybacks (distributed as rewards to liquidity providers)

• 33.3% in stablecoins (additional yield for stablecoin/ALKIMI providers)

• 33.3% to protocol operations (ensuring sustainable growth)

Figure 6: Alkimi’s AdFi fee revenue distribution

4.3. Zero Day Payments for Publishers

Publishers can convert their outstanding invoices into instant liquidity, paying up to 15% in fees to eliminate 90-day payment delays that impact cash flow.

This solution revolutionises the financing of advertising through:

• Publishers improving cash flow without factoring or bank loans

• Up to 15% fees creating sustainable yields for the ALKIMI ecosystem

• Every publisher using this feature directly increasing token holder returns

The combination of protocol fees and zero-day payments ensures ALKIMI holders earn from every transaction, whether publishers choose instant payment or not.

4.4. The AdFi Flywheel

The system operates as a reinforcing cycle. Publishers join to access early payments. As transaction volume grows, platform fees increase. This attracts more liquidity providers due to higher yields. As liquidity deepens, publishers can access greater % 's of accrued revenue earlier, encouraging further adoption. Increased volume leads to larger buybacks. Each component of AdFi accelerates accrual of value within the AdFi ecosystem:

Publishers Join → More advertiser spend → Increased protocol fees for stakers

More Volume → Larger fee pool → Higher APYs attract more liquidity

Deeper Liquidity → Better rates for publishers → Faster adoption

Increased Adoption → More buyback volume → Token price support

Example:

If 100 publishers averaging $1 million monthly volume adopt AdFi, this generates $100 million monthly flow.

At 5% average fees, this equals $5 million monthly, $60 million annually, flowing to ALKIMI holders.

If these publishers access liquidity on day 0, resulting in an additional 10% early payment fee, this could amount to $9.5 million monthly, $114 million annually flowing to ALKIMI holders. ($100mil volume - $5mil protocol fee * 15% early payment fee).

Each new publisher adds more than linear value; they make the system more attractive for the next publisher, creating the framework for exponential growth. Each rotation strengthens the ecosystem and multiplies value for early participants.

5. Alkimi on Sui: Strategic Infrastructure Choice

The decision to migrate to Sui stems from both performance requirements and strategic purpose. Sui provides decentralisation, scalability, high throughput and low latency, making it ideal for real-time advertising transactions.

Sui's composability facilitates on-chain data logic, enabling verifiable and transparent payment structures. The ecosystem alignment, including strategic support from the Sui Foundation, enables Alkimi to build a unique product suite for long-term value creation for holders, advertisers and publishers.

5.1 The Full Stack Advantage

Alkimi stands as the first Sui partner to leverage the complete technology stack to deliver enterprise-grade advertising solutions with blockchain-native transparency and decentralisation. Alkimi’s full-stack integration creates competitive advantages versus Web2 infrastructure whilst delivering the performance needed to solve issues prevalent in digital advertising.

5.2 Core Technology Components

Sui’s Blockchain powers Alkimi's verifiable, outcome-based transactions. Every impression, click, and conversion records immutably, providing unprecedented transparency between advertisers and publishers. This on-chain verification eliminates disputes and attracts premium advertisers willing to pay higher CPMs for transparency.

Mysticeti Consensus offers ideal performance for ad exchanges through sub-second finality (<400ms) and processing capacity of hundreds of thousands of transactions per second. This enables instantaneous bid processing, auction settlement, and impression tracking across millions of daily transactions, critical for real-time bidding (RTB) systems operating within strict 100-millisecond timeout windows.

Walrus provides cost-effective, secure, and decentralised storage handling Alkimi's requirement for massive scale, with Alkimi currently delivering over ~20 million ad impressions daily. As Alkimi expands across global publishers and brands, Walrus ensures the data infrastructure remains fast, reliable, cost-effective and secure.

Nautilus enables independent validation of ad impressions and financial reconciliation within trusted execution environments (TEEs). TEEs ensure payments based on accurate, verifiable delivery data, eliminating disputes and building trust.

Seal protects sensitive ad impression metadata through advanced encryption and access controls. With no reliance on centralised infrastructure, Seal allows Alkimi to maintain brand, publisher and audience confidentiality whilst remaining fully decentralised.

5.3 Strategic Value Creation

The migration to Sui delivers direct value to ALKIMI holders through multiple channels:

Enhanced Yield Generation: Sui's sub-second finality enables Alkimi to process millions of ad transactions daily at minimal cost. Lower costs translate directly to higher net protocol fees flowing to stakers.

Unlimited Scalability: Supporting 2+ billion annual transactions, Sui accommodates Alkimi's growth from ~20 million daily impressions to billions without network congestion impacting fee revenue.

Ecosystem Liquidity Access: Sui's 1 million active users and $2 billion TVL provide immediate access to liquidity for AdFi pools and potential new platform users.

6. What Makes Alkimi Different

Unlike token projects promising future utility, Alkimi delivers proven results today. The protocol generates $200,000+ in quarterly fees from Fortune 500 advertisers including Coca-Cola, AWS, Publicis, Kraken, and Fox, flowing directly to token holders. Whilst other DeFi protocols rely on unsustainable emissions, Alkimi's yields derive from completed advertising transactions anchored in verified, real-world business activity.

6.1 Competitive Advantages

First-Mover Advantage: As the only on-chain ad exchange processing 20 million daily impressions, Alkimi has established partnerships and proven technology that competitors would need years to replicate.

Network Effects: The platform creates a self-reinforcing growth cycle. Every publisher joining for instant payments attracts more advertisers, increasing volume and yields, which generates more liquidity and accelerates adoption.

Technical Superiority: As Sui's first full-stack advertising application, Alkimi leverages infrastructure competitors cannot match. Sub-second transactions and enterprise-grade security attract premium brands that require transparency and performance.

6.2 The AdFi Revolution

AdFi transcends traditional DeFi protocols by building the rails for the financialisation of a $750 billion industry.

By solving real problems; 90-day payment delays, 40% fees, and opacity of fees, Alkimi creates a sustainable value engine benefiting token holders, publishers and advertisers alike.

The result: a token backed by growing revenue, protected by network effects, and positioned to capture a significant share of global advertising cash flows. Alkimi provides the vehicle for the future of digital advertising, where transparency and efficiency replace the opaque, inefficient systems of incumbents.

The strategic partnership with the Sui Foundation, combined with the platform's revenue-driven buyback mechanisms and comprehensive AdFi liquidity provisions, creates a unique value proposition in the DeFi space.

Essential Resources

• Security Audits: Asymptotic Audit report available

• Community Support:

Telegram: @Alkimi_Exchange

Discord: https://discord.gg/zSVpQy4Nwu

Email: help@alkimi.org

• Platform Access: labs.alkimi.org

Alkimi Secures Strategic Investment from Sui to Fix Broken Ad Ecosystem

Ex-Meta blockchain team backs Alkimi’s agentic media platform as the future of outcome-based, decentralised advertising.

Read now

How Alkimi and Sui Are Fixing the Broken Ad Ecosystem

A first-of-its-kind partnership will bring billions in ad spend on-chain

Read now

HOW ALKIMI IS TOKENISING THE $750BN DIGITAL ADS MARKET

Alkimi pioneers tokenization of intangible assets like digital ads via its decentralized ad exchange. Discover...

Read now